Page 42 - Real Estate Laws and Customs - State by State Guide by Old Republic Title

P. 42

State Locations

A STATE - BY - STATE GUIDE

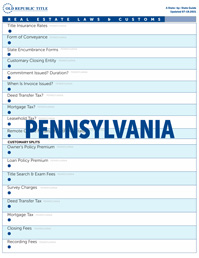

REAL ESTATE LAWS AND CUSTOMS PENNSYLVANIA

Title Insurance Rates PENNSYLVANIA

Filed

Form of Conveyance PENNSYLVANIA

Special Warranty Deed; General Warranty Deed

State Encumbrance Forms PENNSYLVANIA

Mortgage

Customary Closing Entity PENNSYLVANIA

Title or Escrow Company; Others

Commitment Issued? Duration? PENNSYLVANIA

Yes; 6 Months

When Is Invoice Issued? PENNSYLVANIA

With Commitment

Deed Transfer Tax? PENNSYLVANIA

Yes; Realty Transfer Tax (State/Local Municipalities)

Mortgage Tax? PENNSYLVANIA

No

Leasehold Tax? PENNSYLVANIA

Yes; Realty Transfer Tax If ≤ 30 Years (Including Options to Renew)

Remote Online Notarization (RON) Status PENNSYLVANIA

In Effect

CUSTOMARY SPLITS

Owner’s Policy Premium PENNSYLVANIA

Buyer Pays

Loan Policy Premium PENNSYLVANIA

Buyer Pays

Title Search and Exam Fees PENNSYLVANIA

Included in Premium

Survey Charges PENNSYLVANIA

Buyer Pays

Deed Transfer Tax PENNSYLVANIA

Divided Equally

Mortgage Tax PENNSYLVANIA

Not Applicable

Closing Fees PENNSYLVANIA

Included in Premium

Recording Fees PENNSYLVANIA

Buyer Pays to Record Deed and Mortgage

Seller Pays to Record Documents to Remove Encumbrances

UCC coverage is available; for assistance with your transaction contact UCC@oldrepublictitle.com 42

oldrepublictitle.com/ncs Updated 07/2023