Page 312 - ALTA Endorsements Guide

P. 312

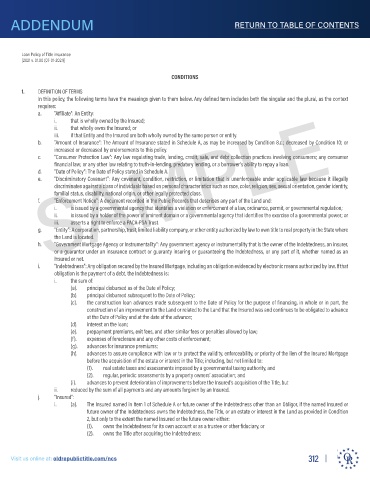

ADDENDUM RETURN TO TABLE OF CONTENTS

Loan Policy of Title insurance

[2021 v. 01.00 (07-01-2021)]

CONDITIONS

1. DEFINITION OF TERMS

In this policy, the following terms have the meanings given to them below. Any defined term includes both the singular and the plural, as the context

requires:

a. “Affiliate”: An Entity:

i. that is wholly owned by the Insured;

ii. that wholly owns the Insured; or

iii. if that Entity and the Insured are both wholly owned by the same person or entity.

b. “Amount of Insurance”: The Amount of Insurance stated in Schedule A, as may be increased by Condition 8.c.; decreased by Condition 10; or

increased or decreased by endorsements to this policy.

c. “Consumer Protection Law”: Any law regulating trade, lending, credit, sale, and debt collection practices involving consumers; any consumer

financial law; or any other law relating to truth-in-lending, predatory lending, or a borrower’s ability to repay a loan.

d. “Date of Policy”: The Date of Policy stated in Schedule A.

“Discriminatory Covenant”: Any covenant, condition, restriction, or limitation that is unenforceable under applicable law because it illegally

e. SAMPLE

discriminates against a class of individuals based on personal characteristics such as race, color, religion, sex, sexual orientation, gender identity,

familial status, disability, national origin, or other legally protected class.

f. “Enforcement Notice”: A document recorded in the Public Records that describes any part of the Land and:

i. is issued by a governmental agency that identifies a violation or enforcement of a law, ordinance, permit, or governmental regulation;

ii. is issued by a holder of the power of eminent domain or a governmental agency that identifies the exercise of a governmental power; or

iii. asserts a right to enforce a PACA-PSA Trust.

g. “Entity”: A corporation, partnership, trust, limited liability company, or other entity authorized by law to own title to real property in the State where

the Land is located.

h. “Government Mortgage Agency or Instrumentality”: Any government agency or instrumentality that is the owner of the Indebtedness, an insurer,

or a guarantor under an insurance contract or guaranty insuring or guaranteeing the Indebtedness, or any part of it, whether named as an

Insured or not.

i. “Indebtedness”: Any obligation secured by the Insured Mortgage, including an obligation evidenced by electronic means authorized by law. If that

obligation is the payment of a debt, the Indebtedness is:

i. the sum of:

(a). principal disbursed as of the Date of Policy;

(b). principal disbursed subsequent to the Date of Policy;

(c). the construction loan advances made subsequent to the Date of Policy for the purpose of financing, in whole or in part, the

construction of an improvement to the Land or related to the Land that the Insured was and continues to be obligated to advance

at the Date of Policy and at the date of the advance;

(d). interest on the loan;

(e). prepayment premiums, exit fees, and other similar fees or penalties allowed by law;

(f). expenses of foreclosure and any other costs of enforcement;

(g). advances for insurance premiums;

(h). advances to assure compliance with law or to protect the validity, enforceability, or priority of the lien of the Insured Mortgage

before the acquisition of the estate or interest in the Title; including, but not limited to:

(1). real estate taxes and assessments imposed by a governmental taxing authority, and

(2). regular, periodic assessments by a property owners’ association; and

(i). advances to prevent deterioration of improvements before the Insured’s acquisition of the Title, but

ii. reduced by the sum of all payments and any amounts forgiven by an Insured.

j. “Insured”:

i. (a). The Insured named in Item 1 of Schedule A or future owner of the Indebtedness other than an Obligor, if the named Insured or

future owner of the Indebtedness owns the Indebtedness, the Title, or an estate or interest in the Land as provided in Condition

2, but only to the extent the named Insured or the future owner either:

(1). owns the Indebtedness for its own account or as a trustee or other fiduciary, or

(2). owns the Title after acquiring the Indebtedness;

Visit us online at: oldrepublictitle.com/ncs s 312

c

n

tl

s o

n

.

e

c

/

om

ti

epu

r

n

e a

t

old

li

:

l

b

c

i

t u

i

V

i

s