Page 41 - Homeowners Manual - Nevada

P. 41

FIRPTA WITHHOLDING RULE

Under the Foreign Investment in Real Property Tax Act (FIRPTA) of 1980, a foreign person who sells a real

property interest located in the U�S� is subject to a tax withholding at disposition� This regulation requires the

buyer in such a transaction to withhold 10-15% of the “amount realized” from the sale and remit it to the Internal

Revenue Service (IRS) unless one or more exemptions apply to the seller or the transaction�

Although the requirement to withhold and remit funds to the IRS falls on the buyer, typically the closing agent

does withhold and remit funds or prepare exemption affidavit forms to be delivered to the IRS at the time of

closing� The seller’s real estate agent plays an important role in encouraging the seller to consult with their tax

professional early in the transaction process to address any potential issues that may delay their closing� Some

tax professionals may recommend submitting an early tax return application for any excess withholding� This is

particularly important as the IRS has reported that refunds filed after withholding may take up to 12 months to

process�

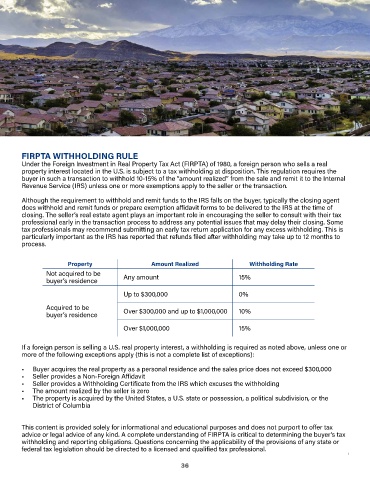

Property Amount Realized Withholding Rate

Not acquired to be Any amount 15%

buyer’s residence

Up to $300,000 0%

Acquired to be Over $300,000 and up to $1,000,000 10%

buyer’s residence

Over $1,000,000 15%

If a foreign person is selling a U�S� real property interest, a withholding is required as noted above, unless one or

more of the following exceptions apply (this is not a complete list of exceptions):

• Buyer acquires the real property as a personal residence and the sales price does not exceed $300,000

• Seller provides a Non-Foreign Affidavit

• Seller provides a Withholding Certificate from the IRS which excuses the withholding

• The amount realized by the seller is zero

• The property is acquired by the United States, a U�S� state or possession, a political subdivision, or the

District of Columbia

This content is provided solely for informational and educational purposes and does not purport to offer tax

advice or legal advice of any kind� A complete understanding of FIRPTA is critical to determining the buyer’s tax

withholding and reporting obligations� Questions concerning the applicability of the provisions of any state or

federal tax legislation should be directed to a licensed and qualified tax professional�

(*Based on City/County of where property is located� Check with your Real Estate Professional�)

36