Page 32 - Homeowners Manual - Orange County

P. 32

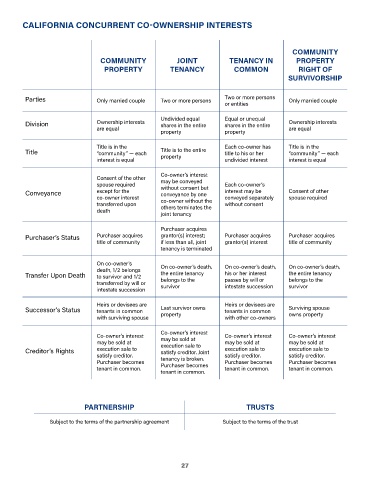

Note: If a married person enters into a joint tenancy that does not include their spouse, the title company insuring

title may require the spouse of the married man or woman acquiring title to specifically consent to the joint

tenancy. The same rules will apply for same sex married couples and domestic partners.

4. Tenancy in Common: A form of vesting title to property owned by any two or more individuals in undivided

fractional interests. These fractional interests may be unequal in quantity or duration and may arise at different

times. Each tenant in common owns a share of the property, is entitled to a comparable portion of the income

from the property and must bear an equivalent share of expenses. Each co-tenant may sell, lease or will to

his/her heir that share of the property belonging to him/her. For example: Bruce Buyer, a single man, as to an

undivided 3/4 interest and Penny Purchaser, a single woman, as to an undivided 1/4 interest.

Other Ways of Vesting Title include as:

1. A Corporation*: A corporation is a legal entity, created under state law, consisting of one or more shareholders

but regarded under law as having an existence and personality separate from such shareholders.

2. A Partnership*: A partnership is an association of two or more persons who can carry on business for profit

as co-owners, as governed by the Uniform Partnership Act. A partnership may hold title to real property in the

name of the partnership.

3. Trustees of a Trust*: A Trust is an arrangement whereby legal title to property is transferred by the grantor to

a person called a trustee, to be held and managed by that person for the benefit of the people specified in the

trust agreement, called the beneficiaries. A trust is generally not an entity that can hold title in its own name.

Instead, title is often vested in the trustee of the trust. For example: Bruce Buyer trustee of the Buyer Family Trust.

4. Limited Liability Companies (LLC)*: This form of ownership is a legal entity and is similar to both the

corporation and the partnership. The operating agreement will determine how the LLC functions and is taxed.

Like the corporation its existence is separate from its owners.

*In cases of corporate, partnership, LLC or trust ownership - required documents may include corporate articles and

bylaws, partnership agreements, LLC operating agreements and trust agreements and/or certificates.

1/2025 | Reprinted with permission from clta.org.

27