Page 38 - Homeowners Manual - Sonoma County

P. 38

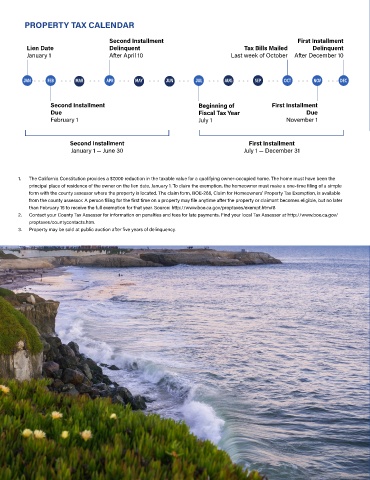

PROPERTY TAX CALENDAR

Second Installment First Installment

Lien Date Delinquent Tax Bills Mailed Delinquent

January 1 After April 10 Last week of October After December 10

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

Second Installment Beginning of First Installment

Due Fiscal Tax Year Due

February 1 July 1 November 1

Second Installment First Installment

January 1 — June 30 July 1 — December 31

1. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the

principal place of residence of the owner on the lien date, January 1. To claim the exemption, the homeowner must make a one-time filing of a simple

form with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners’ Property Tax Exemption, is available

from the county assessor. A person filing for the first time on a property may file anytime after the property or claimant becomes eligible, but no later

than February 15 to receive the full exemption for that year. Source: http://www.boe.ca.gov/proptaxes/exempt.htm#8

2. Contact your County Tax Assessor for information on penalties and fees for late payments. Find your local Tax Assessor at http://www.boe.ca.gov/

proptaxes/countycontacts.htm.

3. Property may be sold at public auction after five years of delinquency.

33