Page 24 - Home Buyers and Sellers Handbook English - California

P. 24

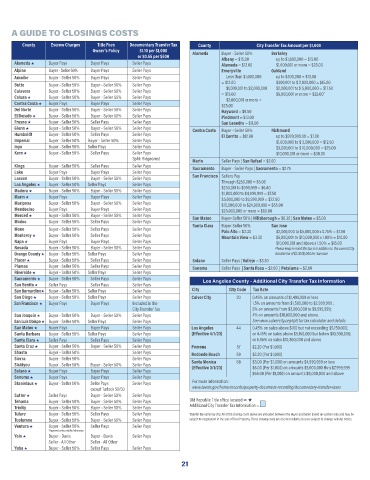

A GUIDE TO CLOSINGS COSTS

County Escrow Charges Title Fees Documentary Transfer Tax County City Transfer Tax Amount per $1,000

Owner’s Policy $1.10 per $1,000 Alameda Buyer - Seller 50% Berkeley

or $0.55 per $500 Albany = $15.00 up to $1,600,000 = $15.00

Alameda Buyer Pays Buyer Pays Seller Pays Alameda = $12.00 $1,600,001 or more = $25.00

Alpine Buyer - Seller 50% Buyer Pays Seller Pays Emeryville Oakland

Amador Buyer - Seller 50% Buyer Pays Seller Pays Less than $1,000,000 up to $300,000 = $10.00

Butte Buyer - Seller 50% Buyer - Seller 50% Seller Pays = $12.00 $300,001 to $ 2,000,000 = $15.00

$1,000,001 to $2,000,000 $2,000,001 to $ 5,000,000 = $17.50

Calavera Buyer - Seller 50% Buyer - Seller 50% Seller Pays = $15.00 $5,000,001 or more = $25.00”

Colusa Buyer - Seller 50% Buyer - Seller 50% Seller Pays $2,000,001 or more =

Contra Costa Buyer Pays Buyer Pays Seller Pays $25.00

Del Norte Buyer - Seller 50% Buyer - Seller 50% Seller Pays Hayward = $8.50

El Dorado Buyer - Seller 50% Buyer - Seller 50% Seller Pays Piedmont = $13.00

Fresno Buyer - Seller 50% Seller Pays Seller Pays San Leandro = $11.00

Glenn Buyer - Seller 50% Buyer - Seller 50% Seller Pays Contra Costa Buyer - Seller 50% Richmond

Humboldt Buyer - Seller 50% Seller Pays Seller Pays El Cerrito = $12.00 up to $999,999.99 = $7.00

Imperial Buyer - Seller 50% Buyer - Seller 50% Seller Pays $1,000,000 to $ 3,000,000 = $12.50

Inyo Buyer - Seller 50% Seller Pays Seller Pays $3,000,001 to $ 10,000,000 = $25.00

Kern Buyer - Seller 50% Seller Pays Seller Pays $10,000,001 or more = $30.00

Split: Ridgecrest Marin Seller Pays | San Rafael = $2.00

Kings Buyer - Seller 50% Seller Pays Seller Pays Sacramento Buyer - Seller Pays | Sacramento = $2.75

Lake Buyer Pays Buyer Pays Seller Pays

Lassen Buyer - Seller 50% Buyer - Seller 50% Seller Pays San Francisco Sellers Pay

Los Angeles Buyer - Seller 50% Seller Pays Seller Pays Through $250,000 = $5.00

Madera Buyer - Seller 50% Buyer - Seller 50% Seller Pays $250,001 to $999,999 = $6.80

$1,000,000 to $4,999,999 = $7.50

Marin Buyer Pays Buyer Pays Seller Pays $5,000,000 to $9,999,999 = $22.50

Mariposa Buyer - Seller 50% Buyer - Seller 50% Seller Pays $10,000,000 to $24,999,999 = $55.00

Mendocino Buyer Pays Buyer Pays Seller Pays $25,000,000 or more = $60.00

Merced Buyer - Seller 50% Buyer - Seller 50% Seller Pays San Mateo Buyer-Seller 50% | Hillsborough = $0.30 | San Mateo = $5.00

Modoc Buyer - Seller 50% Seller Pays Seller Pays

Mono Buyer - Seller 50% Seller Pays Seller Pays Santa Clara Buyer-Seller 50% San Jose

Palo Alto = $3.30

$2,000,000 to $5,000,000 x 0.75% = $7.50

Monterey Buyer - Seller 50% Seller Pays Seller Pays Mountain View = $3.30 $5,000,001 to $10,000,000 x 1.00% = $10.00

Napa Buyer Pays Buyer Pays Seller Pays $10,000,001 and above x 1.50% = $15.00

Nevada Buyer - Seller 50% Buyer - Seller 50% Seller Pays Please keep in mind this tax is in addition to the current City

Orange County Buyer - Seller 50% Seller Pays Seller Pays transfer tax of $3.30/$1,000 for San Jose

Placer Buyer - Seller 50% Seller Pays Seller Pays Solano Seller Pays | Vallejo = $3.30

Plumas Buyer - Seller 50% Seller Pays Seller Pays Sonoma Seller Pays | Santa Rosa = $2.00 | Petaluma = $2.00

Riverside Buyer - Seller 50% Seller Pays Seller Pays

Sacramento Buyer - Seller 50% Seller Pays Seller Pays Los Angeles County - Additional City Transfer Tax Information

San Benito Seller Pays Seller Pays Seller Pays

San Bernardino Buyer - Seller 50% Seller Pays Seller Pays City City Code Tax Rate

San Diego Buyer - Seller 50% Seller Pays Seller Pays Culver City 20 0.45% on amounts of $1,499,999 or less

San Francisco Buyer Pays Buyer Pays Included in the 1.5% on amounts from $1,500,000 to $2,999,999 ;

City Transfer Tax 3% on amounts from $3,000,000 to $9,999,999;

San Joaquin Buyer - Seller 50% Buyer - Seller 50% Seller Pays 4% on amounts $10,000,000 and above.

San Luis Obispo Buyer - Seller 50% Seller Pays Seller Pays See www.culvercity.org/rptt for tax calculator and details

San Mateo Buyer Pays Buyer Pays Seller Pays Los Angeles 44 0.45% on sales above $100 but not exceeding $5,150,000;

Santa Barbara Buyer - Seller 50% Seller Pays Seller Pays (Effective 4/1/23) or 4.45% on sales above $5,150,000 but below $10,300,000;

Santa Clara Seller Pays Seller Pays Seller Pays or 5.95% on sales $10,300,000 and above

Santa Cruz Buyer - Seller 50% Buyer - Seller 50% Seller Pays Pomona 57 $2.20 (Per $1,000)

Shasta Buyer - Seller 50% Seller Pays Redondo Beach 59 $2.20 (Per $1,000)

Sierra Buyer - Seller 50% Seller Pays

Siskiyou Buyer - Seller 50% Buyer - Seller 50% Seller Pays Santa Monica 68 $3.00 (Per $1,000) on amounts $4,999,999 or less

$6.00 (Per $1,000) on amounts $5,000,000 thru $7,999,999

(Effective 3/1/23)

Solano Buyer Pays Buyer Pays Seller Pays $56.00 (Per $1,000) on amounts $8,000,000 and above

Sonoma Buyer Pays Buyer Pays Seller Pays

Stanislaus Buyer - Seller 50% Seller Pays Seller Pays For more information:

except Turlock 50/50 www.lavote.gov/home/records/property-document-recording/documentary-transfer-taxes

Sutter Seller Pays Buyer - Seller 50% Seller Pays

Tehama Buyer - Seller 50% Buyer - Seller 50% Seller Pays Old Republic Title office located =

Trinity Buyer - Seller 50% Buyer - Seller 50% Seller Pays Additional City Transfer Tax Information =

Tulare Buyer - Seller 50% Seller Pays Seller Pays Transfer Tax varies by city. All of the closing costs above are allocated between the Buyer and Seller based on custom only and may be

Tuolumne Buyer - Seller 50% Buyer - Seller 50% Seller Pays subject to negotiation in the sale of Real Property. These closing costs are deemed reliable, but are subject to change without notice.

Ventura Buyer - Seller 50% Seller Pays Seller Pays

*Approved unless notified otherwise

Yolo Buyer - Davis Buyer - Davis Seller Pays

Seller - All Other Seller - All Other

Yuba Buyer - Seller 50% Seller Pays Seller Pays

21