Page 27 - Home Buyers and Sellers Handbook English - California

P. 27

How will the amount of my bill be determined?

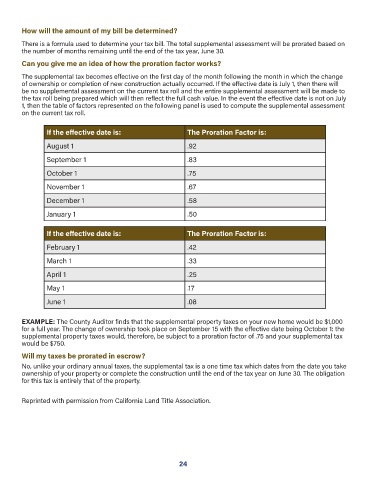

There is a formula used to determine your tax bill. The total supplemental assessment will be prorated based on

the number of months remaining until the end of the tax year, June 30.

Can you give me an idea of how the proration factor works?

The supplemental tax becomes effective on the first day of the month following the month in which the change

of ownership or completion of new construction actually occurred. If the effective date is July 1, then there will

be no supplemental assessment on the current tax roll and the entire supplemental assessment will be made to

the tax roll being prepared which will then reflect the full cash value. In the event the effective date is not on July

1, then the table of factors represented on the following panel is used to compute the supplemental assessment

on the current tax roll.

If the effective date is: The Proration Factor is:

August 1 .92

September 1 .83

October 1 .75

November 1 .67

December 1 .58

January 1 .50

If the effective date is: The Proration Factor is:

February 1 .42

March 1 .33

April 1 .25

May 1 .17

June 1 .08

EXAMPLE: The County Auditor finds that the supplemental property taxes on your new home would be $1,000

for a full year. The change of ownership took place on September 15 with the effective date being October 1: the

supplemental property taxes would, therefore, be subject to a proration factor of .75 and your supplemental tax

would be $750.

Will my taxes be prorated in escrow?

No, unlike your ordinary annual taxes, the supplemental tax is a one time tax which dates from the date you take

ownership of your property or complete the construction until the end of the tax year on June 30. The obligation

for this tax is entirely that of the property.

Reprinted with permission from California Land Title Association.

24