Page 31 - Home Buyers and Sellers Guide - Hawaii

P. 31

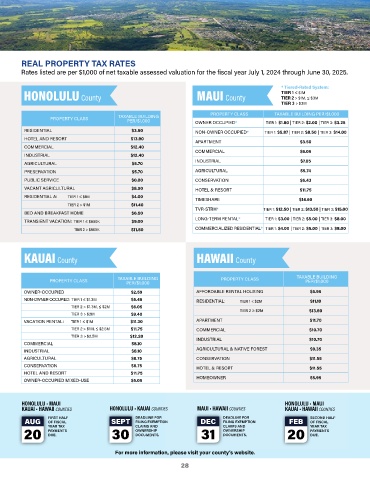

REAL PROPERTY TAX RATES

Rates listed are per $1,000 of net taxable assessed valuation for the fiscal year July 1, 2025 through June 30, 2026.

HONOLULU County MAUI County

PROPERTY CLASS TAXABLE BUILDING PROPERTY CLASS TAXABLE BUILDING PER/$1,000

PER/$1,000

OWNER OCCUPIED TIER 1: $1.65 | TIER 2: $1.80 | TIER 3: $5.75

RESIDENTIAL $3.50 Tier 1: ≤ $1.3M | Tier 2: > $1.3M, ≤ $4.5M | Tier 3: > $4.5M

HOTEL AND RESORT $13.90 NON-OWNER OCCUPIED TIER 1: $5.87 | TIER 2: $8.60 | TIER 3: $17.00

Tier 1: ≤ $1M | Tier 2: > $1M, ≤ $3M | Tier 3: > $3M

COMMERCIAL $12.40 APARTMENT $3.50

INDUSTRIAL $12.40 COMMERCIAL $6.05

AGRICULTURAL $5.70 INDUSTRIAL $7.05

PRESERVATION $5.70 AGRICULTURAL $5.74

CONSERVATION $6.43

PUBLIC SERVICE $0.00

HOTEL & RESORT $11.80

VACANT AGRICULTURAL $8.50

TIMESHARE $14.70

RESIDENTIAL A: TIER 1 ≤ $1M $4.00 TIER 1: $12.50 | TIER 2: $14.00 | TIER 3: $15.55

TIER 2 > $1M $11.40 TVR-STRH Tier 1: ≤ $1M | Tier 2: > $1M, ≤ $3M | Tier 3: > $3M

BED AND BREAKFAST HOME $6.50 LONG-TERM RENTAL TIER 1: $2.95 | TIER 2: $5.00 | TIER 3: $8.50

Tier 1: ≤ $1.3M | Tier 2: > $1.3M, ≤ $3M | Tier 3: > $3M

TRANSIENT VACATION: TIER 1 ≤ $800K $9.00 TIER 1: $2.00 | TIER 2: $3.00 | TIER 3: 10.00

TIER 2 > $800K $11.50 COMMERCIALIZED RESIDENTIAL Tier 1: ≤ $1M | Tier 2: > $1M, ≤ $3M | Tier 3: > $3M

KAUAI County HAWAII County

PROPERTY CLASS TAXABLE BUILDING PROPERTY CLASS TAXABLE BUILDING

PER/$1,000

PER/$1,000

OWNER-OCCUPIED $2.59 AFFORDABLE RENTAL HOUSING $5.95

NON-OWNER-OCCUPIED: TIER 1 ≤ $1.3M $5.45

RESIDENTIAL: TIER 1 < $2M $11.10

TIER 2 > $1.3M, ≤ $2M $6.05

TIER 3 > $2M $9.40 TIER 2 ≥ $2M $13.60

VACATION RENTAL: TIER 1 ≤ $1M $11.30 APARTMENT $11.70

TIER 2 > $1M, ≤ $2.5M $11.75 COMMERCIAL $10.70

TIER 3 > $2.5M $12.20

COMMERCIAL $8.10 INDUSTRIAL $10.70

INDUSTRIAL $8.10 AGRICULTURAL & NATIVE FOREST $9.35

AGRICULTURAL $6.75 CONSERVATION $11.55

CONSERVATION $6.75

HOTEL AND RESORT $11.75 HOTEL & RESORT $11.55

OWNER-OCCUPIED MIXED-USE $5.05 HOMEOWNER $5.95

HONOLULU • MAUI HONOLULU • MAUI

KAUAI • HAWAII COUNTIES HONOLULU • KAUAI COUNTIES MAUI • HAWAII COUNTIES KAUAI • HAWAII COUNTIES

AUG FIRST HALF SEPT DEADLINE FOR DEC DEADLINE FOR FEB SECOND HALF

OF FISCAL

FILING EXEMPTION

FILING EXEMPTION

OF FISCAL

20 YEAR TAX 30 CLAIMS AND 31 CLAIMS AND 20 YEAR TAX

OWNERSHIP

OWNERSHIP

PAYMENTS

PAYMENTS

DUE.

DOCUMENTS.

DUE.

DOCUMENTS.

For more information, please visit your county’s website.

28