Page 32 - Home Buyers and Sellers Guide - Hawaii

P. 32

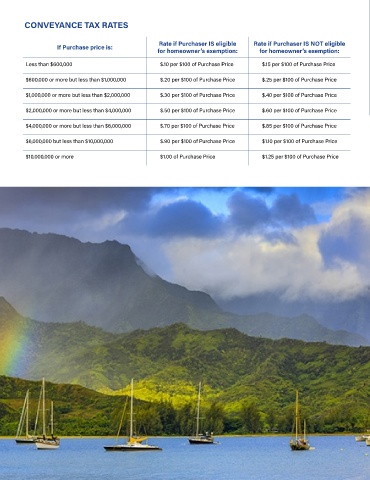

CONVEYANCE TAX RATES

Rate if Purchaser IS eligible Rate if Purchaser IS NOT eligible

If Purchase price is:

for homeowner’s exemption: for homeowner’s exemption:

Less than $600,000 $.10 per $100 of Purchase Price $.15 per $100 of Purchase Price

$600,000 or more but less than $1,000,000 $.20 per $100 of Purchase Price $.25 per $100 of Purchase Price

$1,000,000 or more but less than $2,000,000 $.30 per $100 of Purchase Price $.40 per $100 of Purchase Price

$2,000,000 or more but less than $4,000,000 $.50 per $100 of Purchase Price $.60 per $100 of Purchase Price

$4,000,000 or more but less than $6,000,000 $.70 per $100 of Purchase Price $.85 per $100 of Purchase Price

$6,000,000 but less than $10,000,000 $.90 per $100 of Purchase Price $1.10 per $100 of Purchase Price

$10,000,000 or more $1.00 of Purchase Price $1.25 per $100 of Purchase Price

29