Page 2 - California Partial Schedule of Title Insurance Premiums

P. 2

Old Republic Title Partial Schedule of Title Insurance Premiums

Rates effective March 17, 2025

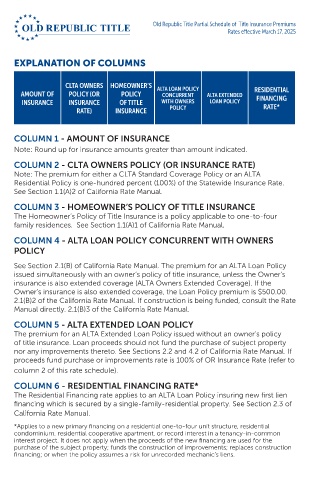

EXPLANATION OF COLUMNS

CLTA OWNERS HOMEOWNER’S ALTA LOAN POLICY RESIDENTIAL

AMOUNT OF POLICY (OR POLICY CONCURRENT ALTA EXTENDED FINANCING

INSURANCE INSURANCE OF TITLE WITH OWNERS LOAN POLICY RATE*

RATE) INSURANCE POLICY

COLUMN 1 - AMOUNT OF INSURANCE

Note: Round up for insurance amounts greater than amount indicated.

COLUMN 2 - CLTA OWNERS POLICY (OR INSURANCE RATE)

Note: The premium for either a CLTA Standard Coverage Policy or an ALTA

Residential Policy is one-hundred percent (100%) of the Statewide Insurance Rate.

See Section 1.1(A)2 of California Rate Manual.

COLUMN 3 - HOMEOWNER’S POLICY OF TITLE INSURANCE

The Homeowner’s Policy of Title Insurance is a policy applicable to one-to-four

family residences. See Section 1.1(A)1 of California Rate Manual.

COLUMN 4 - ALTA LOAN POLICY CONCURRENT WITH OWNERS

POLICY

See Section 2.1(B) of California Rate Manual. The premium for an ALTA Loan Policy

issued simultaneously with an owner’s policy of title insurance, unless the Owner’s

insurance is also extended coverage (ALTA Owners Extended Coverage). If the

Owner’s insurance is also extended coverage, the Loan Policy premium is $500.00.

2.1(B)2 of the California Rate Manual. If construction is being funded, consult the Rate

Manual directly. 2.1(B)3 of the California Rate Manual.

COLUMN 5 - ALTA EXTENDED LOAN POLICY

The premium for an ALTA Extended Loan Policy issued without an owner’s policy

of title insurance. Loan proceeds should not fund the purchase of subject property

nor any improvements thereto. See Sections 2.2 and 4.2 of California Rate Manual. If

proceeds fund purchase or improvements rate is 100% of OR Insurance Rate (refer to

column 2 of this rate schedule).

COLUMN 6 - RESIDENTIAL FINANCING RATE*

The Residential Financing rate applies to an ALTA Loan Policy insuring new first lien

financing which is secured by a single-family-residential property. See Section 2.3 of

California Rate Manual.

*Applies to a new primary financing on a residential one-to-four unit structure, residential

condominium, residential cooperative apartment, or record interest in a tenancy-in-common

interest project. It does not apply when the proceeds of the new financing are used for the

purchase of the subject property; funds the construction of improvements; replaces construction

financing; or when the policy assumes a risk for unrecorded mechanic’s liens.